I’m writing this article because I see Government Bonds all across the globe are headed toward a Death Spiral.

I will try to give logical explanation and analysis on how’s that happening which I think Keynesian Economist lack.

So firstly, we will see what Keynesian Economist have done from Post – World War era.

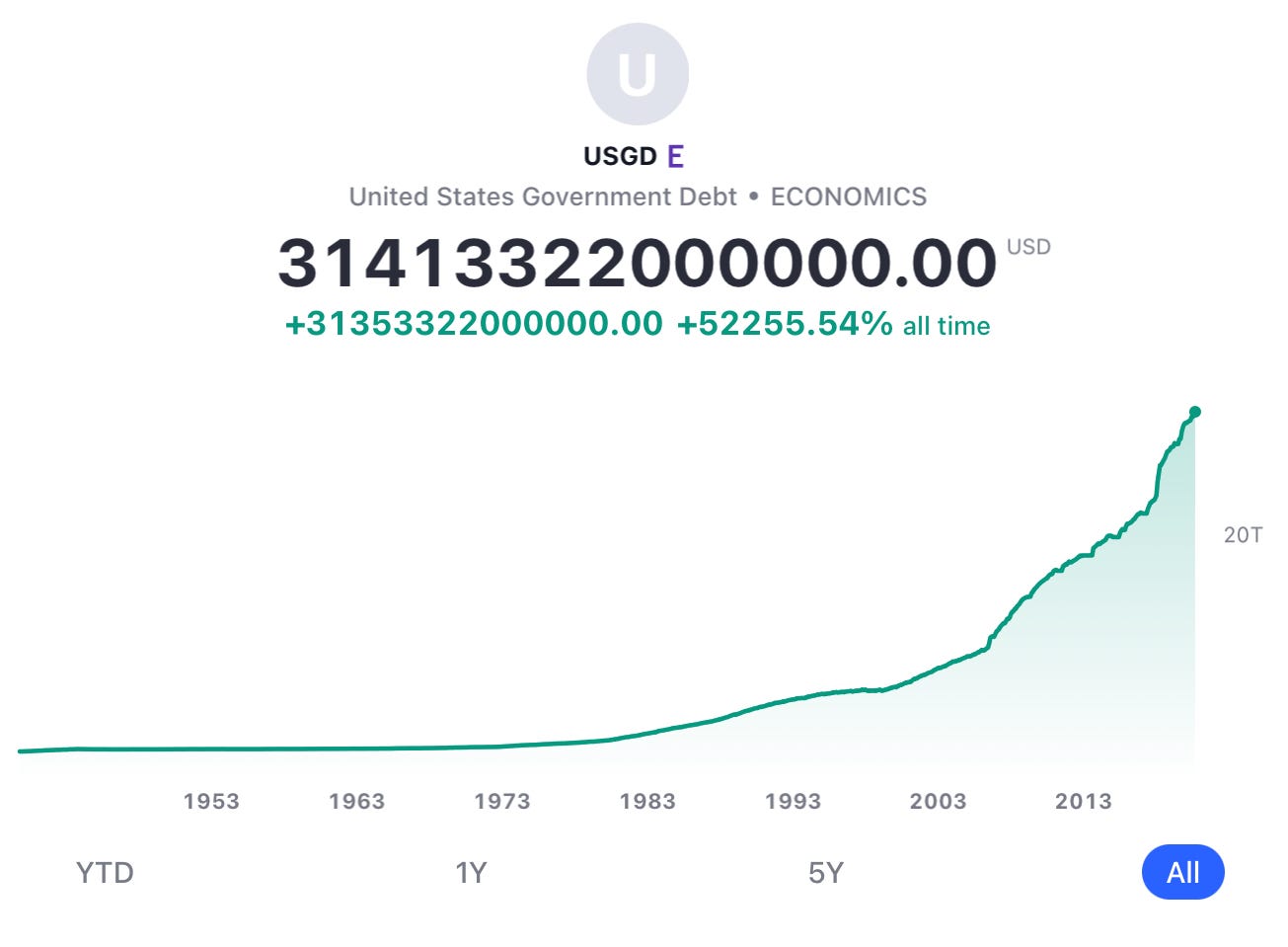

Keynesian have done only one thing that’s creating debt. As Keynesian literates believe that to sustain economy you need create debt. That’s a different topic to address but here we see that the graph has just gone Parabolical.

31 trillion is just the National Debt. The unfunded debt is 173 trillion and is rising.

It’s a debt clock and by the time of my writing it must have increase. You can see liabilities in different sector and that’s insane amount of debt.

The above graph is showing currency in circulation. That too has the same story as we have discussed above. It’s just debt and debt and debt……….

Now let’s see what the hell is going in the bond market.

The interest rate on bonds is just in a Hyperbolic graph.

Its just near zero, which we will discuss later but we can analyze from this graph that returns on bonds are decreasing exponentially. “So, we can say that people don’t like holding bonds” but to confirm that the statement I said holds true we need to first see inflation.

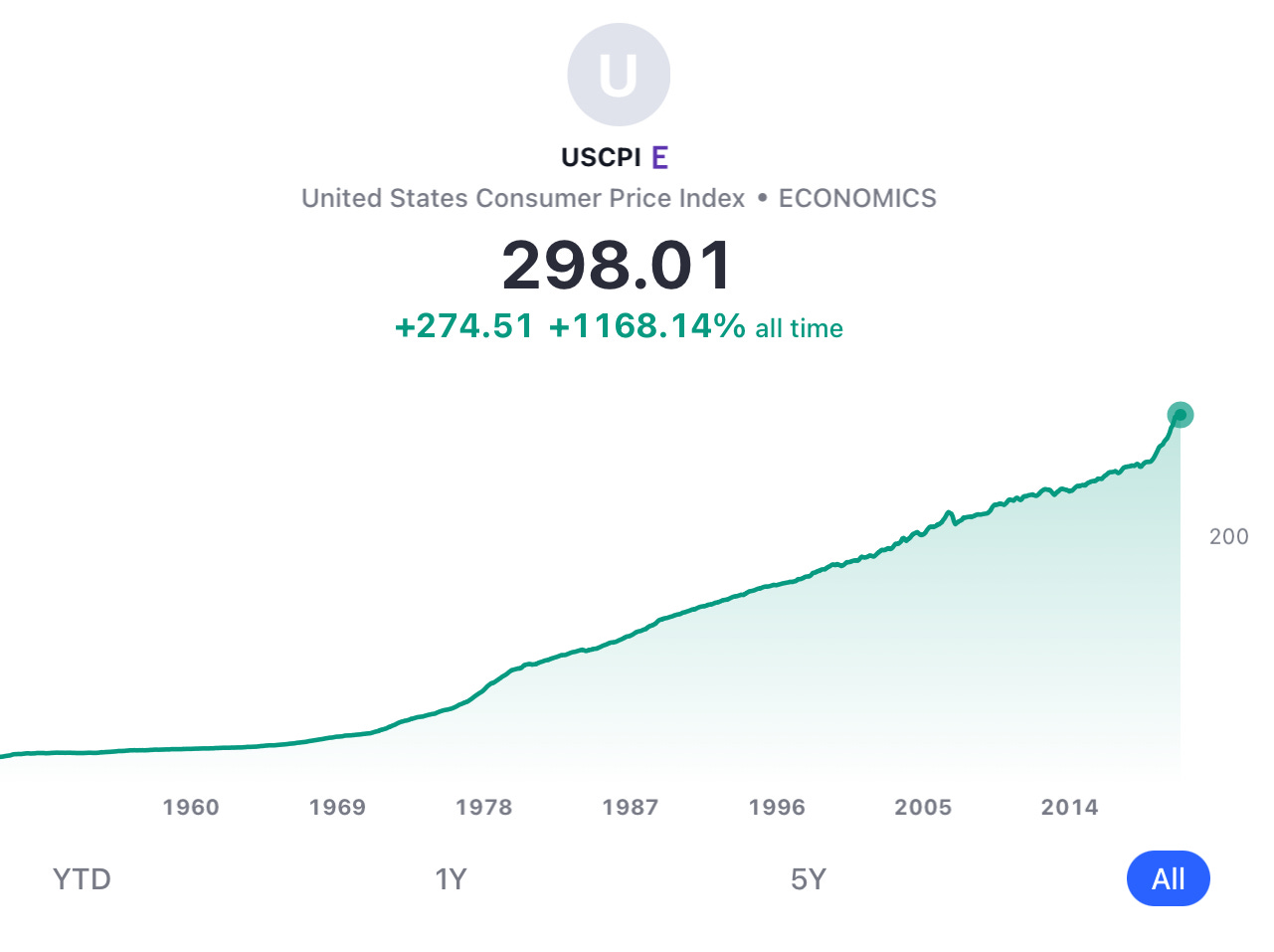

So, the above graph shows CPI. As I have given Keynesians an upper hand on this flawed inflation index. As I think to see real inflation, I prefer stock indices. But even seeing CPI we can easily appreciate that it’s forming a perfect 45 degree angle. Inflation remains totally unchecked.

So, we can clearly analyze that interest rate have been declining over the years, so inflation remains unchecked and sadly Keynesians have created total bubble economy.

To prove that ‘inflation is unchecked” the Treasury Inflation-Indexed Bonds have reached negative value which means inflation is totally unchecked and we are in a bubble economy.

What’s happening in 2022

The dumb Keynesians economist media all across the main stream media are convincing people that Feds are increasing interest rates and everything is gonna be fine. There will be temporary pain and blah blah blah.

So what’s actually happening:

Feds are increasing rate that’s true. They are telling people that they are going to have safe landing and soon they will decrease rates, so temporary pain will be in the market and economy will recover.

But the reality is that these stupid Keynesians know that they have fucked up. Feds know that they have fucked up.

Now I’m going to explain how the whole bond market is in a death spiral.

So, what Keynesians do during inflation is that they start increasing interest rates. They do so to contract money supply. So, Keynesians think that by doing so people are going to buy bonds because people get paid higher interest rates on it and they can contract money supply in the system which will further reduce inflation and when they reach a deflationary environment, they are going to increase money supply by lowering interest rates.

There are many other things that go into it but that is the core principle.

So we have seen in the past when market crashes, bonds are considered to be the safe heaven as you get more yield and the conventional 60/40 stock – bond portfolio remains positive.

But this time things got out of control because Keynesian economics is just data based with no real practical explanation.

As we can see above this 60/40 portfolio just got rekt. This means that allocating your funds in so called “safe heaven bonds” are not so safe.

What’s the reason for bonds not performing?

The reality is that Keynesian economist just created a big bond bubble. The bubble have just started to pop. The truth is that not banks but “Governments are going to default”.

Sounds crazy. let’s see how.

So, we have two scenarios:

1) Feds pivots.

2) Feds keep on increasing rates till there is deflationary environment.

In the first scenario, if the Feds decide that they have caused enough pain in the market and would start to pivot, which means decreasing interest rates, it will lead to hyperinflation.

Why hyperinflation?

To understand why let’s see what Feds have done in past 10-12 years. They have just given bailouts and added garbage on their balance sheet.

If they pivot, their bonds are going to collapse as no one is going to buy their bonds as interest rates are already in a hyperbolic trajectory. Eventually US will end up holding that junk bond which no nations are going to buy.

Also, we can see that they are offloading their junk on other nations, so that’s not what Feds are going to do.

Here we can see that China and Japan who hold the maximum percentage of US Treasury are now active sellers and they are just dumping bonds.

They are dumping it at the cost of inflating their currency.

The harsh reality about fiat is that dollar is the main node in the network and rest of the fiat currency just depend upon dollar which is the main node.

USD/JPY just inflated after they started dumping US treasury.

Same story with USD/CNY.

So many countries are buying US bonds so as to maintain their FOREX reserves and to prevent hyperinflation of their fiat currency.

So in this bonds Ponzi scheme fiat countries are going to get rekt.

These countries are going to get rekt.

The first option doesn’t look viable so why not keep increasing interest rates till there is deflationary environment.

This path leads to total self-destruction. Let’s understand how.

Firstly, all businesses are gonna get rekt. As rates keeps on rising everyone who is on debt are going to default.

As Keynesian believe that higher rise in interest rates will lead to gain in credit but increase in interest rate will lead to increase in defaulters so, creditors loses money.

This will eventually lead to total halt in lending.

So eventually government needs to step in and would print more money otherwise there’s going to be economic depression.

So, if this is the case so okay then if we have just messed up the economy why not go through the pain and suffer economic depression.

Here comes the biggest problem of all, which is government is going to default on their bonds. Which means that government will be unable to payback to their bond holders.

This graph shows how much they have to pay interest on bonds and if this rise in interest rate continues this graph is going “to the moon”.

Interesting fact is that its just on public debt which is 31 trillion but US has 173 trillion in unfunded liabilities. So, folks this path too is headed to self-destruction.

People with fiat mentality are unable to think that even governments could ever default. Here we see three occasions where stock to bonds return is negative and in above two i.e., in 1931 and 1969 governments have defaulted. They repriced the value of gold as they were on gold standard and the scam continued.

Clearly seen on charts.

To see the DEBT-SPIRAL even if you go for the first option which was eventually headed to hyperinflation, governments are going to default anyway.

This is the debt ceiling and united states have just kept on increasing that ceiling and eventually made it a joke.

I call it “THE DEBT-SPIRAL” because governments have only two options and both lead to same conclusion:

1) Either its hyperinflation and eventually defaulting and collapse of bonds.

2) Or facing depression and accelerating getting default.

So, there is no escape to be honest and that’s the saddest part of all.

Governments will try to delay it by evil methods which is by CBDC’s or creating infinite debt, which is all in all a different issue.

The final take by me is that our economy is run by Keynesian economist who don’t understand what money really is and if you don’t understand what money is you keep on creating foolish theorems and solve hypothetical problems.

“This is your last chance. After this, there is no turning back. You take the blue pill - the story ends, you wake up in your bed and believe whatever you want to believe. You take the orange pill - you stay in Wonderland and I show you how deep the rabbit-hole goes.”

Excellent description about the drowning world economy. we need a more open and decentralised market. We must have the right to spend our money as we want to and not as guided by the money making govts.